FUNDAMENTALLY GOOD STOCKS ARE HARDEST TO FIND AMONG 5000+ STOCKS IN THE STOCK MARKET , BUT WE HAVE FIND OUT THE TOP 5 STOCKS FOR YOU

TO FIND OUT THESE FUNDAMENTALLY 5 GOOD STOCKS I HAVE DEVOTED MY 3 DAY’S OF CONTINOUS HARWORK , HOPE THIS HELPS YOU

query used to find fundamentally good stocks

- Market capitalization > 500 AND

- Price to earning < 20 AND

- Return on capital employed > 20% AND

- YOY Quarterly sales growth > 0 AND

- Promoter holding > 70 AND

- Profit growth > 0 AND

- Sales growth > 0 AND

- EPS > 50 AND

- Debt to equity < 0.5

POINTS TO BE TAKEN UNDER CONDITION WHILE CHOOSING

- this are one of the signal’s to choose fundamentally good stocks

- good market capitalization state that the company is well established .

- if the promoter has more stake holding in the company this shows he has belief in his company

- Less the Debt to equity more valuable the company

- positive profit and sales growth states that the company is going under a good direction

Table of Contents

1. Nitta Gelatin

INFO: Nitta Gelatin India is involved in the manufacturing and sale of ossein, gelatin and collagen peptide . it exports it product to 35+ countries

1 YEAR RETURN : 117 %

FUNDAMENTALS :

OPNION : The company has generated a rOCE of 34% and ROE of 29%. which is considered to be rare in stock market

CREDIT : https://www.screener.in/company/KERALACHEM/consolidated/

COMPANY : gelatin.in

2. H.G. Infra Engineering

INFO: hg infra deals with the construction of road infrastructure .IT Also deals with the Maintenance of roads, bridges, flyovers and other infrastructure contract works

1 YEAR RETURN : 53 %

FUNDAMENTALS :

OPNION : The company has generated a rOCE of 26% and rOE of 30% which shows a sign of consistency

CREDIT : https://www.screener.in/company/HGINFRA/consolidated/

COMPANY : shardamotor.com

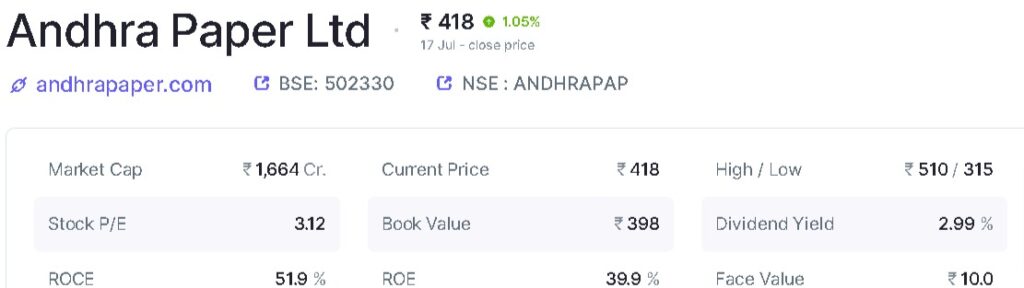

3. Andhra Paper

INFO: andhra paper operates in the business of manufacturing of paper works . the company produces writing & printing paper

1 YEAR RETURN : 25 %

FUNDAMENTALS :

OPNION : company has a rOCE of 52% and and rOE of 40% , With A Dividend Yield of 3% this shows the company is doing a very good job , as well company has give a return of 25 % in 1 year . This shows the Continuous

CREDIT : https://www.screener.in/company/ANDHRAPAP/#top

COMPANY : andhrapaper.com

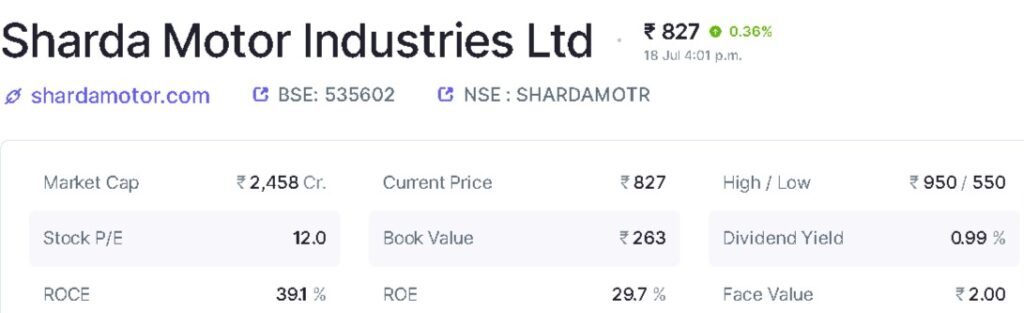

4. Sharda Motor Industries

INFO: Sharda Motor Industries Ltd is primarily engaged in the manufacturing and assembly of Auto Components.

The company's clients include Hyundai, Mahindra, Tata, Maruti Suzuki, Cummins, Carrier, TAFE, MAGNA, SML Isuzu, Nissan, Escorts, MAN, Isuzu, Force Motors, Ashok Leyland and Kubota

1 YEAR RETURN : 11 %

FUNDAMENTALS :

OPNION : The company manufactures component for all the leading automobile company , this shows credibility of this company . As well as this company has given a ROCE of 40 % and ROE of 30% which is extremely good , this shows the consistence and the hard work of the company .

CREDIT : https://www.screener.in/company/SHARDAMOTR/

COMPANY : shardamotor.com

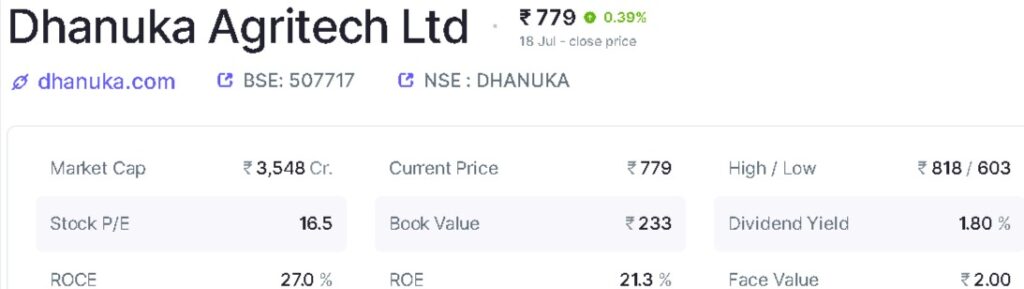

5. Dhanuka Agritech

INFO: Dhanuka Agritech is involved in the sector of agrochemicals and has 300+ wide range of products like Herbicides, insecticides, fungicides

1 YEAR RETURN : 12 %

FUNDAMENTALS :

OPNION : The company has more than 90+ products along every segment and Has 40 warehouses, 7,000+ distributors and 80,000+ retailers, enabling it to have a presence across 10 million farmers . The company has generated a rOCE of 27% and rOE of 21% which shows a sign of consistency

CREDIT : https://www.screener.in/company/DHANUKA/consolidated/

COMPANY : dhanuka.com

So This were the top 5 fundamentally good stocks in this segment , the stocks selected in this segment were very strictly chosen , we consider various things to from market cap to promoter holding

DISCLAIMER : We Are Not SEBI Registered , take this as a piece of advice , do you own research while investing the list mentioned is my personal opinion , do not take this as an investment advice